The U.S. outspends other nations in research and development and continues to lead the world in innovations and inventions. However, new products are often “stranded in the lab” when we don't have the manufacturing capability, or get developed in other countries such as China, Germany, and South Korea that invest more aggressively in manufacturing technology research and development. Every research and development investment on the part of a manufacturer, big or small, amounts to a business risk.

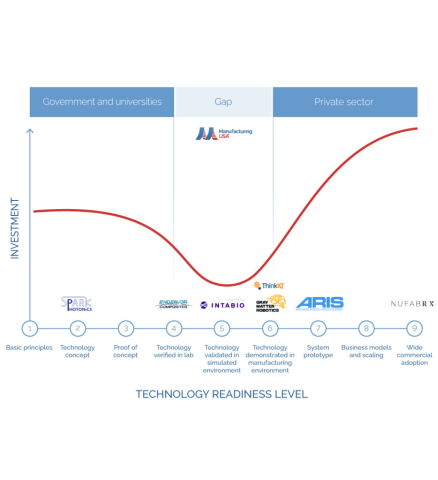

The gap between a good idea and a successful commercial product is known as the “innovation valley of death.” It’s part of the complex history in which manufacturers and investors struggled to keep operations on shore and develop innovations domestically when lower cost options existed elsewhere. The additional business risk associated with investments in prototyping and product development also hinder the creation of new companies that can drive innovation in manufacturing.

This dynamic was a key driver in the creation of Manufacturing USA to help secure U.S. global leadership in advanced manufacturing by connecting people, ideas, and technology.

The Manufacturing USA network, which has roots in 2012 with the creation of America Makes, has grown to include 16 manufacturing innovation institutes. They work within the “innovation valley of death” to accelerate and de-risk technology development and scale-up manufacturing through an ecosystem of government research institutions, universities, and private sector industry members. Collectively, the institutes are crucial vehicles to help transition “leap-ahead” technologies through research, design, prototyping, and production.

In the past decade the institutes have combined to advance 270 such technologies toward commercialization. A tangible outcome of building their ecosystems is the emergence of startup companies that are moving new technologies through the "innovation valley of death" and to the manufacturing floor.

How Startups Emerge to Bridge the Innovation Valley of Death

The Manufacturing USA network's ecosystem of government research institutions, universities and private sector industry members works in cutting-edge collaborative facilities to help bridge the "innovation valley of death." Here are some startup companies in the network.

Funding, Access to Equipment, and Partnership Accelerate Innovation

According to Dr. Sasha Stolyarov, CEO of Advanced Functional Fabrics of America (AFFOA), the Manufacturing USA institutes are all public-private partnerships using a similar approach to drive innovation that incorporates three dynamics:

- Funding through project calls, enabled by grants, government funding, and private sector investments

- Providing access to capital equipment for prototyping new technology that is ripe for development

- Partnerships that provide expertise and networking for companies to innovate where they manufacture

This approach to innovation has benefited startup companies throughout the Manufacturing USA network. Nufabrx, a startup at the intersection of textiles and medicine, was No. 50 on the 2021 Inc. 5000 list of the nation's fastest-growing private companies. Nufabrx was able to accelerate its concepts into products through a project call with AFFOA, using intellectual property developed in the institute ecosystem. Project Calls are a mechanism that AFFOA and other institutes use to seek innovative ideas from members, including startups and manufacturers, to advance development and reduce time to market for innovative products.

Nufabrx’s Healthwear products dispense medicine through fibers in clothing such as an arm sleeve or sock. Its products are now sold in more than 12,000 retail outlets. AFFOA provided more than $1 million to Nufabrx via project calls and awards, which was used to mature their advanced fiber technology and develop an end-to-end supply chain located within a few hours of their base in North Carolina. According to Stolyarov, Nufabrx crossed the “innovation valley of death” in about two years.

Our ability to exist as a company is based on AFFOA. The ability to test-iterate-validate where we manufacture has us at least 10 years further down the path than without AFFOA, if we could do this at all with overseas production

Schindler sees Nufabrx as a platform delivery company. He says there are hundreds of possible applications for Nufabrx to pursue, such as acne, psoriasis, or stimulants to keep soldiers awake on the battlefield. The company plans to remain active with AFFOA as it continues to expand its commercial efforts.

Use of Equipment to Lower Cost of Entry Is a Key Institute Benefit

For Hicham Ghossein, IACMI-The Composites Institute, has been invaluable to his new company because the composites industry has a high cost of entry. He founded Endeavor Composites and has had access to “$10-12 million in [capital] equipment” at the IACMI facility in Knoxville, TN. Endeavor Composites developed ways to repurpose excess carbon fiber from other applications to drastically reduce costs while improving performance for non-woven composites.

There is only a 70% yield in carbon fiber production; the 30% waste becomes Endeavor Composite’s supply. Carbon fiber composite is an attractive material based on its strength and lower weight. Woven composites are especially effective materials, though expensive. Researchers have been working to eliminate defects in cheaper non-woven fabrics for more than 30 years but have been unable to match the performance of woven fabrics.

Endeavor Composites, with IACMI’s help, has developed a new mixing technology for non-woven composites that costs 50% less than woven composites. They are testing a new mixer and building a pilot line that would put them on the path to commercialization and selling non-woven composites to Tier 1 suppliers. “The beginning of 2020, I had one client,” Ghossein said. “Today I have 16 clients. We’re now moving away from a tabletop pilot to actual production by the end of 2022.”

That Tennessee has become one of the world’s advanced composites epicenters has been instrumental to the success of Endeavor Composites. Ghossein said IACMI has played a significant role in building that ecosystem. He said 100% of his suppliers are IACMI members, as are 90% of his advisors and partners. Ghossein says members of his network from larger, more established companies have been a great help in identifying weak spots in the company and how to meet the demands of clients.

Institute Partnerships Help Mature Markets Adopt New Technology

The institute ecosystems do more than transfer technology to startups – they also provide networking and relationship building to help with the adoption of technology in mature markets. One example is Mingu Kang’s ARIS Technology. They had some commercial success with their robotics company, which developed an easy-to-train robotic process for 3D inspection of parts. Artificial Intelligence learns from the robot’s 3D perception data, improving the productivity of the robotic process.

Despite current processes of 3D inspection being labor and training intensive, large manufacturers are hesitant to invest in technologies such as this that may be viewed as potentially disruptive. Kang said many large manufacturers are prone to follow conservative purchasing patterns.

Through the Advanced Robotics for Manufacturing (ARM) Institute, ARIS joined forces with a large automotive manufacturer on human-robot collaboration. They developed an intuitive Augmented Reality user interface for easily programming robotic 3D scanning. They were able to lower the barriers of entry into working with mature companies, which allowed ARIS to work with another automotive manufacturer that was initially hesitant to adopt their new technology. This collaboration was a key development in ARIS gaining the confidence of established companies in the industry.

Developing Solutions for Small Manufacturers

GrayMatter Robotics has developed smart robotic cells for surfacing finishing and treatment applications such as sanding, polishing, and spraying. The company leverages its proprietary Artificial Intelligence algorithms to enable industrial robots to program themselves; technology that can help manufacturers adopt robots for use in high-mix, high-variability manufacturing environments. The time, cost and expertise needed to program robots for each new task have been a significant barrier to adoption for many manufacturers. GrayMatter Robotics’ work is enabling production processes to be reconfigured much more rapidly than in the past.

Co-founder Ariyan Kabir said that the ARM Institute has contributed to the success of GrayMatter Robotics by providing exposure to the robotics manufacturing sector through the institute's network of partners. Members are able to point them to the right sources for building the smart robotic cells, share common pain points and requirements, and identify funding opportunities from government sources and the private sector.

Kabir said the institute is building the next generation of experts among its members through access to intellectual property via software libraries and licensing, sharing information about commercial ideas, and continuing to find the right business partners in terms of complementary skill sets.

A Fresh Perspective on Advanced Manufacturing

Three-quarters of U.S. manufacturers have fewer than 20 employees and do not have extensive research and development capabilities. These examples of startup companies illustrate how the Manufacturing Innovation Institute public-private partnership model is well suited to targeting challenges that are just too big for any one manufacturer to face. The institutes and their ecosystems are working on applied research and development to get solutions in the hands of the U.S. manufacturing community to maintain competitiveness in an ever changing environment.

The varied beginnings of startups associated with the Manufacturing USA institutes illustrate the institutes' impacts in convening and supporting all aspects of the manufacturing sector. Origins for startups becoming involved in institutions include:

- Founders who were involved in institute-founded projects

- Students at member universities

- Employees at member universities and member companies

- Referrals from private sector member companies

- Applicants for a specific project call

- Entrepreneurs in residence

Technology advancements made today by the institutes and their members will lead to new companies or even new markets that provide more Americans with rewarding, living wage jobs. All of this contributes to stronger local, regional, and national economies.

The 17 institutes of the Manufacturing USA network are funded through the departments of Commerce, Defense, and Energy and from private sector industry members. In 2021, the institutes collectively worked with over 2,300 member organizations to collaborate on more than 700 major technology and workforce research and development projects and engaged over 90,000 people in advanced manufacturing training. State, industry, and federal funds contributed $480 million to these activities.

Learn how the Manufacturing USA institutes' facilities are a draw for many early-stage companies.